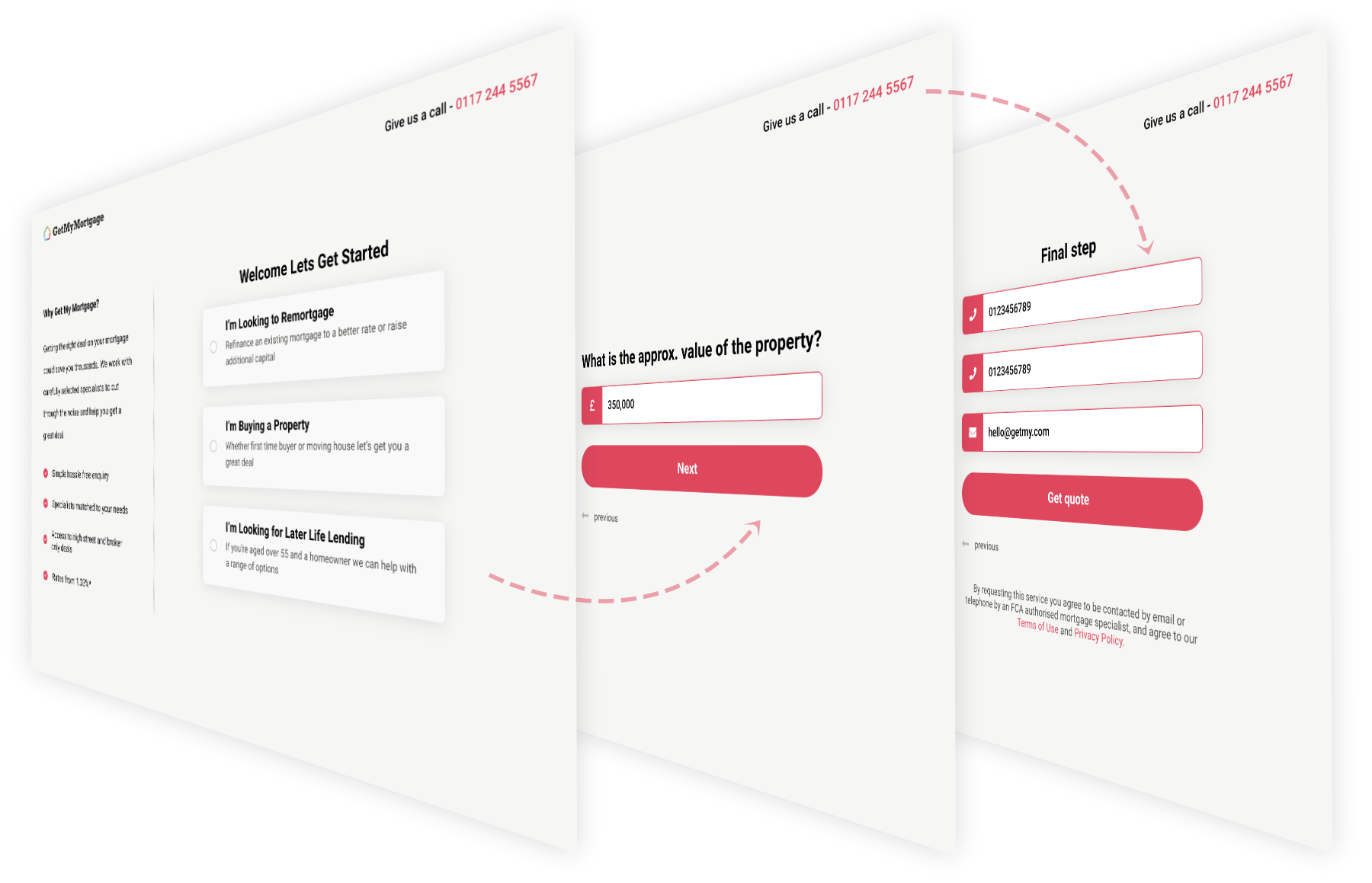

Complete a few simple details about your mortgage needs and property details.

We connect you to an expert mortgage advisor who will search the market and help find the best deal for your needs.

Review your personalised quotes and payment calculations without any pressure.

Choosing a fixed-rate mortgage means that your interest rate will remain the same for a set period.

The advantage to this is that, unlike a variable-rate mortgage (such as a discount or tracker), you'll know what your repayments will be each month.

The advantages of doing this include:

Mortgages with fixed rates of interest are typically two or five-year agreements.

The greatest flexibility is found with two-year fixed rates.

These mortgages are most suitable for borrowers who want to actively manage their mortgage and who regularly switch deals, or those considering moving in the near future.

You can protect your mortgage rate longer with a five-year deal, but they may cost you a little more.

The prospect of locking in a low rate for five years may seem attractive, but you should consider whether you really want to sign an agreement that long.

When you need to pay off your mortgage during a fixed period (such as when you move house or when you remortgage), it can be very expensive due to an early repayment charge (ERC).

If you are unsure how long to fix for, take advice from an independent mortgage adviser.

Getting your original mortgage may have taken a while…

The good news is remortgaging is typically much quicker process & easier to get done.

From start to finish a remortgage will typically take 4 to 6 weeks to complete.

This can be quicker where you have a standard construction property, a good credit record and your income supports mortgage affordability.

You can help speed the process up by getting your documentation lined up ahead of making your remortgage application.

This is where having a mortgage broker looking after your application can make a big difference as they will know how to progress your application and deal with any potential issues.

To talk to one of the remortgage experts we work with complete our quick enquiry form.

A mortgage rate can be fixed for two, three, five, seven and 10 years.

If you select a longer fixed-rate period, the interest rate will generally be higher.

The table below gives you an idea of competitive remortgage fixed interest rates as of May 2022.

Fixed Period |

Fixed Rate |

APRC* |

Loan To Value |

2 Year |

2.10% |

4.20% |

60% |

3 Year |

2.64% |

3.80% |

60% |

5 Year |

2.20% |

3.70% |

60% |

10 Year |

2.31% |

3.10% |

60% |

*APRC – Annual Percentage Rate of Charge

Factors that may make it difficult to get a fixed rate mortgage include:

Fix your mortgage for peace of mind

Considering remortgaging and worried about rising interest rates? You may want to consider a fixed rate mortgage deal.

A fixed rate mortgage can provide peace of mind that your monthly mortgage payments won’t change during the fixed term, regardless of what happens to interest rates.

According to Legal & General from a survey done in February 2022**:

“The cost-of-living squeeze and rising interest rates are clearly driving borrowers to remortgage and lock into low fixed-rate products that are still available on the market.

Others are exploring alternative means of managing their finances, perhaps by taking out interest-only mortgages.”