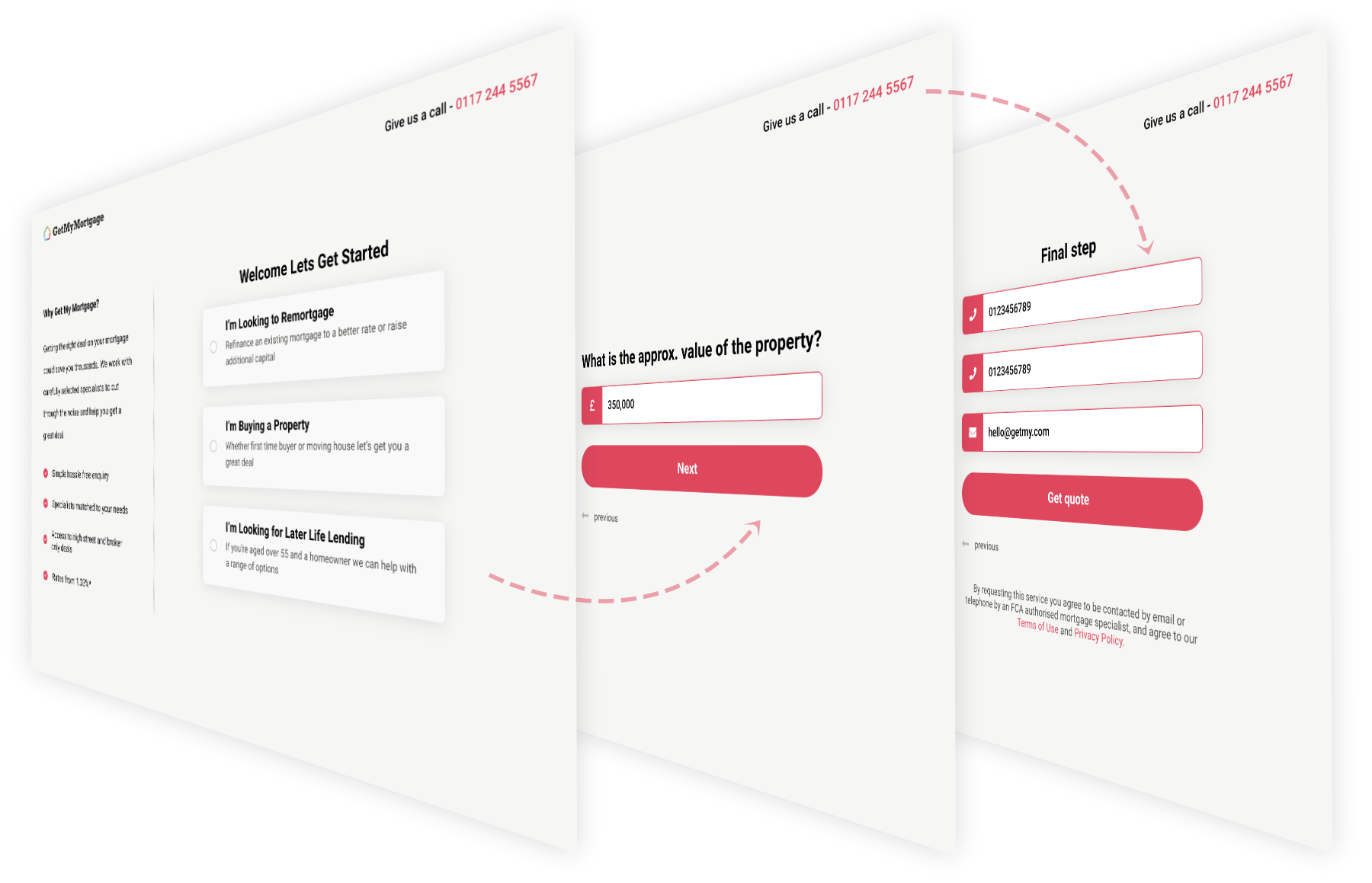

Complete a few simple details about your mortgage needs and property details.

We connect you to an expert mortgage advisor who will search the market and help find the best deal for your needs.

Review your personalised quotes and payment calculations without any pressure.

To get a first-time buyer mortgage a lender will want to know that you are low risk.

So, what will help in getting your application over the line?

To maximize your chance of success we work with a specialist mortgage brokers who understand the first time buyer government schemes and know what product would be suited to your circumstances.

Before you start hunting for your first home you will need to save for a deposit.

As a rule of thumb, you will need at least 5% of the cost of the home you want to purchase.

For example, if you want to buy a £250,000 house you will need to save £12,500 (5%) for the deposit.

Saving more than 5% will give you access to a broader range of cheaper mortgages available on the market and a lower interest rate.

A mortgage is a long term loan (5+ years) taken out to buy property or land.

Most mortgages are taken out for 25 years to spread the cost of buying a property, but the term of the loan can be longer or shorter.

Mortgages are typically taken out through banks and building societies. These lenders will charge interest on the mortgages they offer as well as other fees e.g., Product fees which are added to the loan and early repayment charges if you redeem the mortgage early.

Lenders secure the mortgage you take out by placing a 'charge' on the title to the property. This allows the lender to sell the property if you are not able to keep up repayments on the mortgage.

Before you start hunting for your first home you should have a good idea of what your budget is.

Mortgage lenders need to ensure that the amount you borrow is something you can afford to pay back over time.

As part of their calculations, they will typically apply a multiple of income to determine what they are prepared to lend to you.

While a multiple of income is used by many lenders, other factors will also come into play such as the deposit you have and your monthly outgoings when assessing affordability.

Lenders as part of this assessment can tap into independent data to determine what they see as a reasonable cost for items of expenditure such as food, travel, and entertainment costs based on the number of adults and children (if any) in your household. Lenders will typically analyse your spending behaviour through looking at your last 2 to 3 months’ bank statements.

Existing credit costs such as car loan repayments or credit card bills will also be included.

What level of deposit have you saved up?

Most UK mortgage lenders will require you to have at least a 5% deposit.

If you can put a larger deposit down, then lenders are more likely to offer you a higher income multiple.

In calculating out how much you can borrow most lenders offer an AIP “Agreement in Principle” which is an indication of what loan they are prepared to offer you and on what terms based on your circumstances.

You can get an AIP using our mortgage service. You will need to provide:

In simple terms, a first time buyer is someone who has never owned property before.

According to UK Government guidance notes:

"To count as a first time buyer, a purchaser must not, either alone or with others, have previously acquired a major interest in a dwelling or an equivalent interest in land situated anywhere in the world. This includes previous acquisitions by inheritance or gift, or by a financial institution on behalf of a person under an alternative finance scheme".

In the 2017 budget, the Government announced that Stamp Duty Land Relief would apply to homes under £500,000 if the property is used as the main residence.

To get a 95% mortgage, a lender will want to know that you are low risk.

So, what will help in getting your application over the line?

To maximise your chance of success, we work with specialist mortgage brokers who understand the challenges of getting a mortgage suited to your circumstances.